The business of making forecasts can be a slippery slope. But some investors are willing to “put their money where their mouth is” when it comes to making predictions about what’s next for short-term interest rates, so it can be helpful to check out what they think is going to happen.

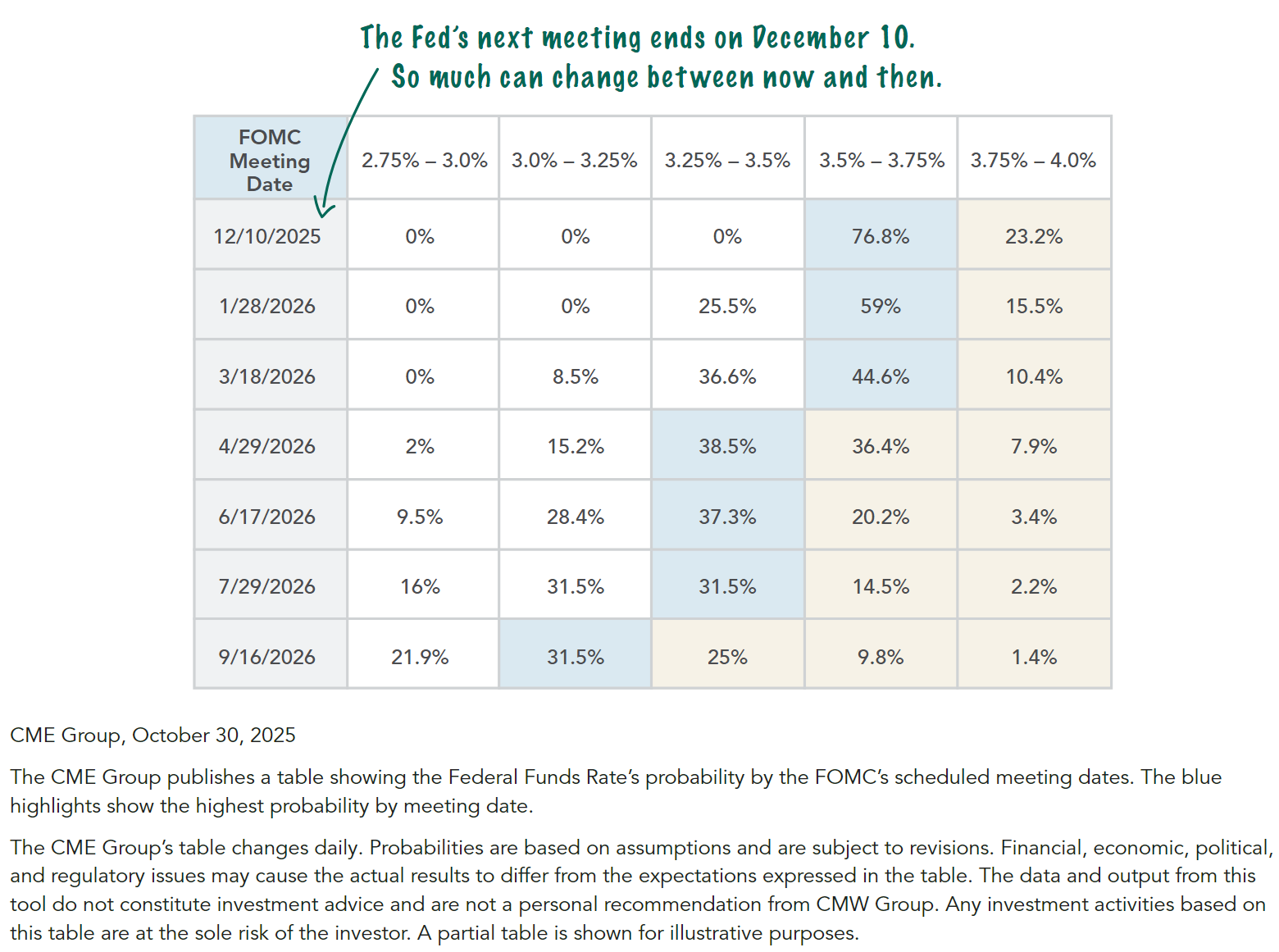

As you can see, speculators anticipate the Fed will lower short-term rates three times in the next 12 months from the current range of between 3.75 percent and 4 percent. And these speculators can place trades if they have a strong enough conviction about the future

Market Outlook for Interest Rates

Market participants anticipate the Fed will cut short-term rates three times in the next 12 months.

Following the Fed’s October meeting, Fed Chair Powell said he wasn’t certain about whether the Fed would adjust rates again in 2025, which jolted the financial markets. Speculators had assumed there was one more rate change “penciled in” for 2025, so the news caught some by surprise.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion,” Powell said.

That’s an important sentence for all investors to keep in mind.

The Fed’s job is to constantly monitor the economy as it sets monetary policy. There are no foregone conclusions—only speculators who attempt to anticipate what’s next.

If rates do trend lower, that may affect everything from mortgage rates to credit cards to automobile loans. It may also prompt a review of some fixed-rate investments.

But let’s not put the cart in front of the horse!

If Fed Chair Powell is not ready to make any conclusion, it’s best for everyone to adopt a wait-and-see approach before making any decisions.

CNBC.com, October 29, 2025. “Fed cuts rates again, but Powell raises doubts about easing at next meeting”

Disclosure

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.

Forecasts are based on assumptions and are subject to revisions over time. Financial, economic, political, and regulatory issues may cause the actual results to differ from the expectations expressed in the forecast.