It’s a simple question, but most get the answer wrong.

Artificial intelligence got it wrong. AI Gemini says, “The purpose of creating a retirement strategy is to act as a comprehensive, disciplined roadmap to convert your long-term financial goals into actions.”

We’ll give that answer partial credit.

The purpose of a retirement strategy is much simpler. It’s about getting where you want, when you want. That’s it. All the other stuff is important, but the purpose of a retirement strategy is to focus on your where and when—leave the “how” part to your Financial Advisor!

When we see articles saying, “active money managers struggle to beat index funds due to tariffs, economic uncertainty,” we believe we’re missing the point. Whether an investment underperforms or outperforms is fun to check out, but it’s about whether the investment helped your where and when.

The Wrong Way to Keep Score?

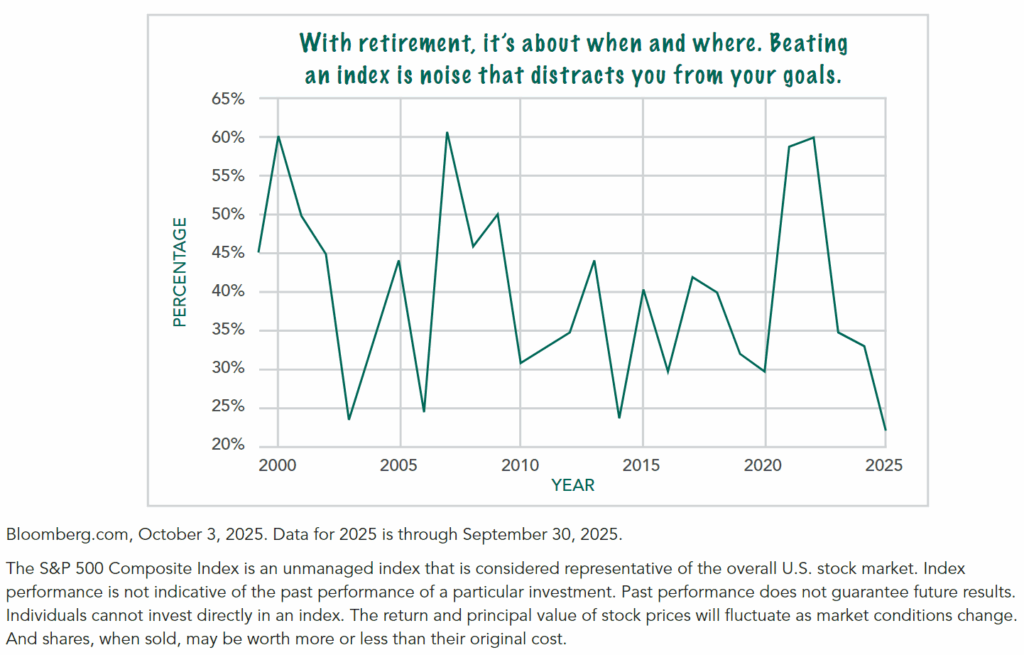

Percentage of active funds beating the Standard & Poor’s 500.

There are a variety of factors that could change your where and when, and those are the issues we need to review when they come up. We start with a strategy, but for almost everyone, “even the best laid plans of mice and men oft go awry.”

So keep these concepts in mind when you read about money managers who are winning and losing. With your retirement strategy, there’s a better way to keep score.

Finance.Yahoo.com, August 29, 2025. “BofA update shows where active managers are putting money”

Disclosure

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.

The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost