This update is overdue, not because we don’t have much to say, but due to the unique situation facing the country. Our backgrounds prepare us to rationalize economic data, market pricing, business fundamentals and the like to gauge risk/reward probabilities. But those feel useless today, as the market is not reacting to traditional concerns: it is entirely about politics, which are changing by the hour.

How will global leaders posture themselves amidst this tumult, and how will President Trump react? Even if we had a Henry Kissinger level understanding of the world order, we would still be at a loss because we can’t read their minds. We admit we are out of our element discussing policy, but we read a lot of varying perspective in our work, so we hope to cut through the noise and provide a balanced summary of trade, deficits, and tariffs.

What is a trade deficit & how America uses it to its advantage

Economics 101 taught us how countries with comparative advantages that specialize and trade are better off. Unfortunately, trading in the real world is not as simple as just exchanging items. Instead, we issue an “IOU” in the form of currency. The US doles out dollars around the world in return for products and services. Our nation consumes far more than we produce in this system. As long as our trading partners trust that our IOUs are good, they accept our paper bills. See next exhibit detailing how over 75% of Mexico and Canada’s exports go to the US, while near half of our exports go to those countries:

Looking at our relationship with China, their low wages attracted American businesses eager to cut costs and maximize profits. The investment surge propelled China’s economy, as they raced to build facilities and hone their manufacturing skills to become a leading supplier to America and the world. Since China was producing goods not only for themselves but also everyone else, their growth accelerated far beyond what would be possible without trade. And, they achieved one of the greatest social transitions in history with an astonishing 800 million Chinese rising from poverty since 1981.

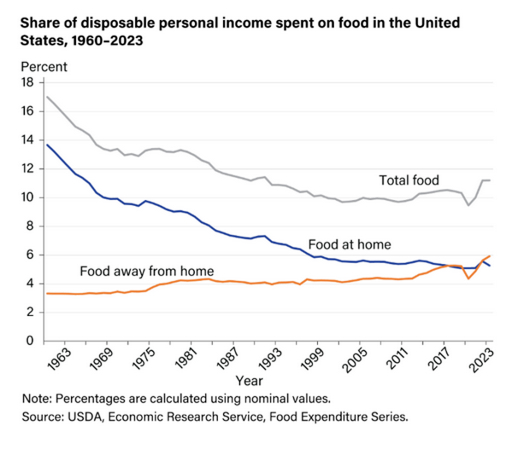

America’s benefit is cheap stuff, which sounds underwhelming compared to China’s lift from poverty, but as the benefits trickle through the economy, they compound and accelerate a cycle of growth. Cheap goods reduce the cost of household necessities like food (chart to left) so consumers have more discretionary income to spend on higher value goods and experiences. In order to meet increasing demand, our workforce began shifting to service and knowledge-based jobs that paid better, thereby fueling more discretionary income and supporting demand…This cycle continuously advanced our economy.

The laptop is a great example on the benefits of trade. One of the first laptops made in the early ’80s cost $1,795 (over $6,000 in today’s dollars), and only had 64KB of memory. Today, you can buy a run-of-the-mill laptop with 8GB (8,000,000KB) of memory for well under half the cost. Every workplace and practically every home in America owns a laptop with access to the internet, which heralded a prolonged period of improving productivity. Furthermore, the proliferation of affordable tech hardware expanded the user base that introduced an enormous opportunity for our leading software companies. For instance, Microsoft’s software scaled across all those cheap laptops, turning them into a ~$3 trillion business employing 225,000 people earning a median pay over $190,000. The story is similar for Facebook, Google, Amazon and many more of our innovative companies that attract top talent as an aspirational employer. This motivated the next generations of workers to learn about these leading innovations and start honing skills like coding and understanding AI to continue pushing innovations.

Then, why is the trade deficit a problem?

A trade deficit is not a major issue at the moment, but when sustained for a long time, the risks grow. Every year we hand China billions of dollars (IOUs) for their goods. As the years go by, China keeps accumulating more dollar reserves that they invest back into our debt (Treasury bonds). However debt is debt, and when you extend a loan, you monitor that borrower’s actions to ensure they will be able to pay you back someday. Thus far, China and the rest of the world have not doubted our ability to pay them back, so they gladly keep accepting dollars for their goods. After all, the US is the strongest economy in the world with a stable currency. We do not arbitrarily confiscate property and we are a reliable and trustworthy partner.

By maintaining a trade deficit for decades, other countries stockpile a substantial amount of IOUs. And, like any debt collector, if they lose faith in the value of the dollar, the whole system stops operating efficiently. If the situation deteriorates, our foreign counter-parties could potentially exert greater influence—sell our Treasuries, make claims on assets, etc.

Bringing it all together

We still agree that the economic text books are correct—all parties are better off when they trade, globalization improved the livelihoods of billions of people around the world, innovation was accelerated, etc. As the largest wealthy country, America’s ability to continue consuming goods and services while driving economic growth meant it was the center of the trading system. Everybody wants to export to American consumers and they accept paper money in

return. However, assuming that we can sustain a trade deficit in perpetuity is a risky proposition…

We believe it is good policy to examine our deficit and begin working with our trading partners on a long term plan to narrow the gap. But, this is not a problem that requires immediate and drastic action. After all, America is one of, if not the top benefactor, of globalization. Therefore, the magnitude of the Trump administration’s tariff policy is adversarial and harming our reputation. We depend on the world’s faith that we will remain the beacon of strength, stability, trust and freedom. To jeopardize our good standing by announcing such a drastic change in policy that even punishes some of our closest allies is concerning and reason enough for pressure across the global stock markets.

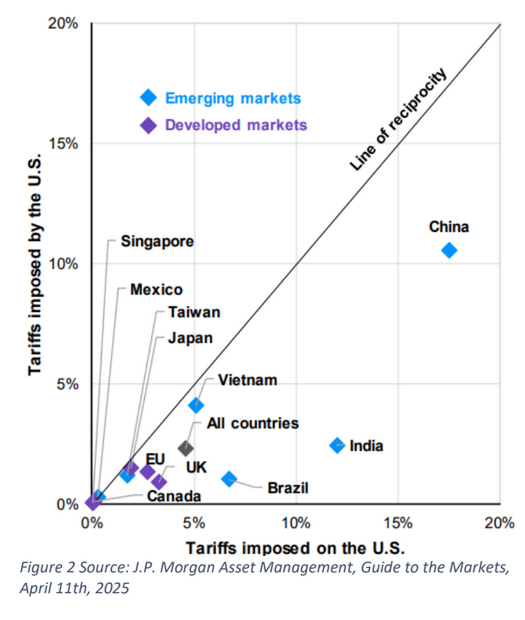

To be clear, not all trade is free and not everyone plays fair. Many countries impose tariffs, import quotas, state subsidies, intellectual property theft and the like to protect their domestic industries. We also must protect our national security, especially if we are losing our critical wartime manufacturing capabilities due to unfair trade. Over many decades, President Trump grieved about other countries taking advantage of America and we got a bad deal. This is true. Most countries are not as open and free to trade as America, and we do support his efforts to level the playing field. But, we should not risk dismantling the economic order that generated decades of prosperity worldwide, and where the foundation is the US dollar that awards America unparalleled advantages. In this instance, applying punitive tariffs as a cure is “worse than the disease.”

St Germain’s take

This is a trade war and stocks are grasping at news bytes (and social media updates) for the slightest hint at a player’s next move. It is so in flux that all the major markets including bonds, commodities and currencies are veering from one mood to another, sometimes within minutes. In fact, the S&P 500 endured intraday moves that rival some of the most dramatic observed during the most tumultuous stretches the past century…We cannot predict the next headline, nor how the dozens of trade policies will settle after negotiations, but we are confident in how to manage investments through uncertain times.

Speculators have a constant urge to act, especially when they watch their portfolio values being wiped away. They must do something that provides a false sense of control, so they trade. Influenced by the herds’ sentiment in the moment, their emotions overwhelm their decisions as they narrowly focus on the short-term.

In contrast, we are investors who appreciate that volatility and an occasional down year is the cost to participate in the incredible wealth generating possibilities over the long-term. During the most tenuous times like today, as during the COVID-19 years, we commit to our investment process that strips away any bias and forces our concentration back

to the fundamentals.

Our process guides us in both the good and bad times, since irrational behavior cuts both ways. Over the past year, speculators were full of optimism and bid up stocks to the highest valuations since the late 90’s. Following the fundamentals and ignoring the herd, we started selling riskier assets. It was not a bet that the market would soon fall, it was simply taking advantage of what we viewed as an overpriced market.

Now, with the current market rout, our de-risking appears prophetic—we assure you, it wasn’t. Looking at the markets today, valuations are more appealing, but we still remain conservatively allocated given the ongoing uncertainty. Encouragingly, we are beginning to find investment opportunities in high quality business that we believe will prosper long-term, and are taking advantage of them, even if the economy dips into recession. Rest assured our investment philosophy and patience has served our clients well in past, and we believe it will again.

DISCLOSURE

The material presented herein is for discussion, informational and educational purposes only. None of the data points, metrics or commentary suggest an investment strategy, tactic or market execution. Before making any investment decision, please consult with a professional investment advisor. Past performance is not an indicator of future performance and/or returns.